Striving to achieve our clients’ investment objectives.

Private Funds

CIM aims to offer private and institutional investors a range of private fund investment opportunities across the risk-return spectrum (core, value-add, opportunistic) focused on real estate. Our fund products will include speciality funds focused on specific property sectors and markets.

Credberg Real Estate Office Opportunities Fund (CREOOF-I)

Strategy

CORE

Sector

OFFICE

Inception

2022

Fund Life

5 + 2 Years

CREOOF-I is a category 2 Alternate Investment Fund (AIF), approved and registered by the Securities and Exchange Board of India (SEBI) sponsored by Credberg Advisors. It aims to provide superior risk-adjusted returns from commercial real estate investments across Core and Core Plus strategies across key Indian cities.

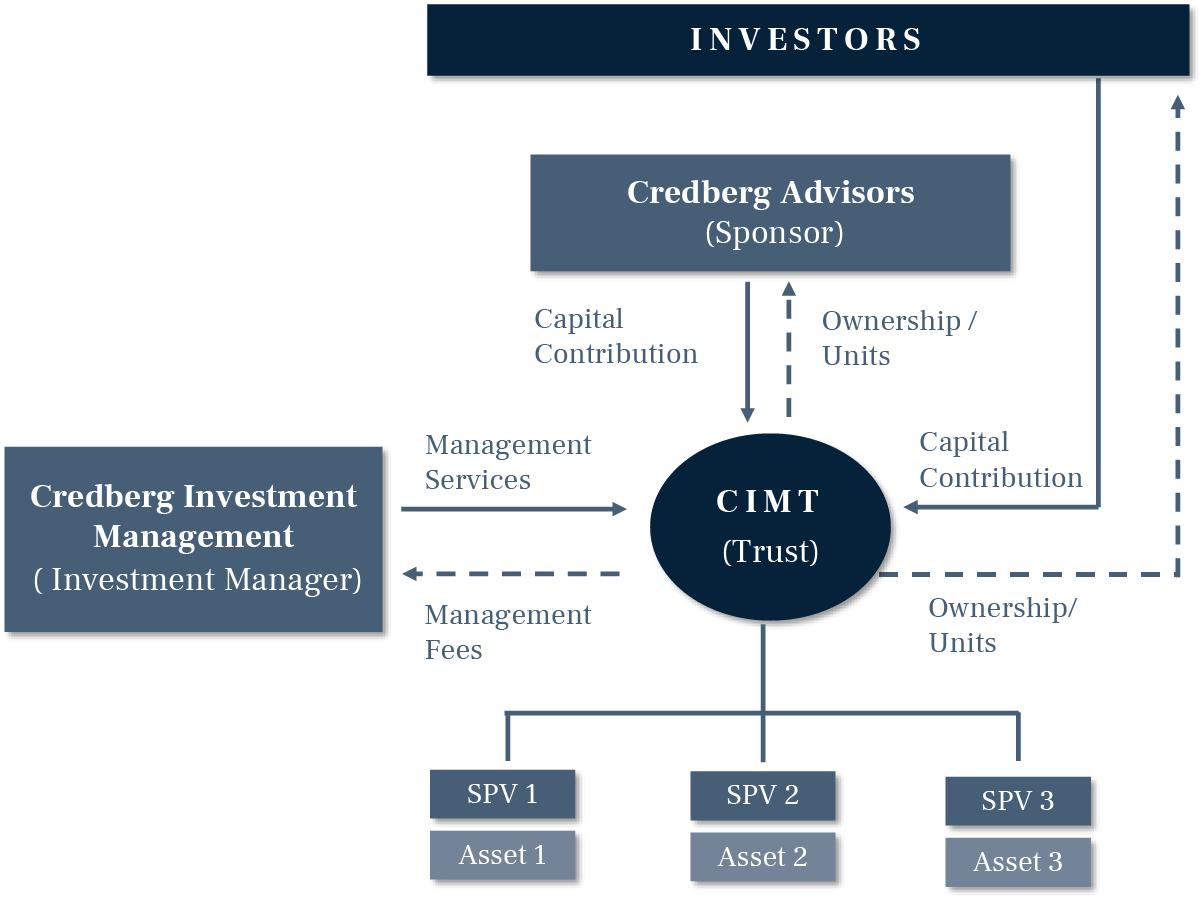

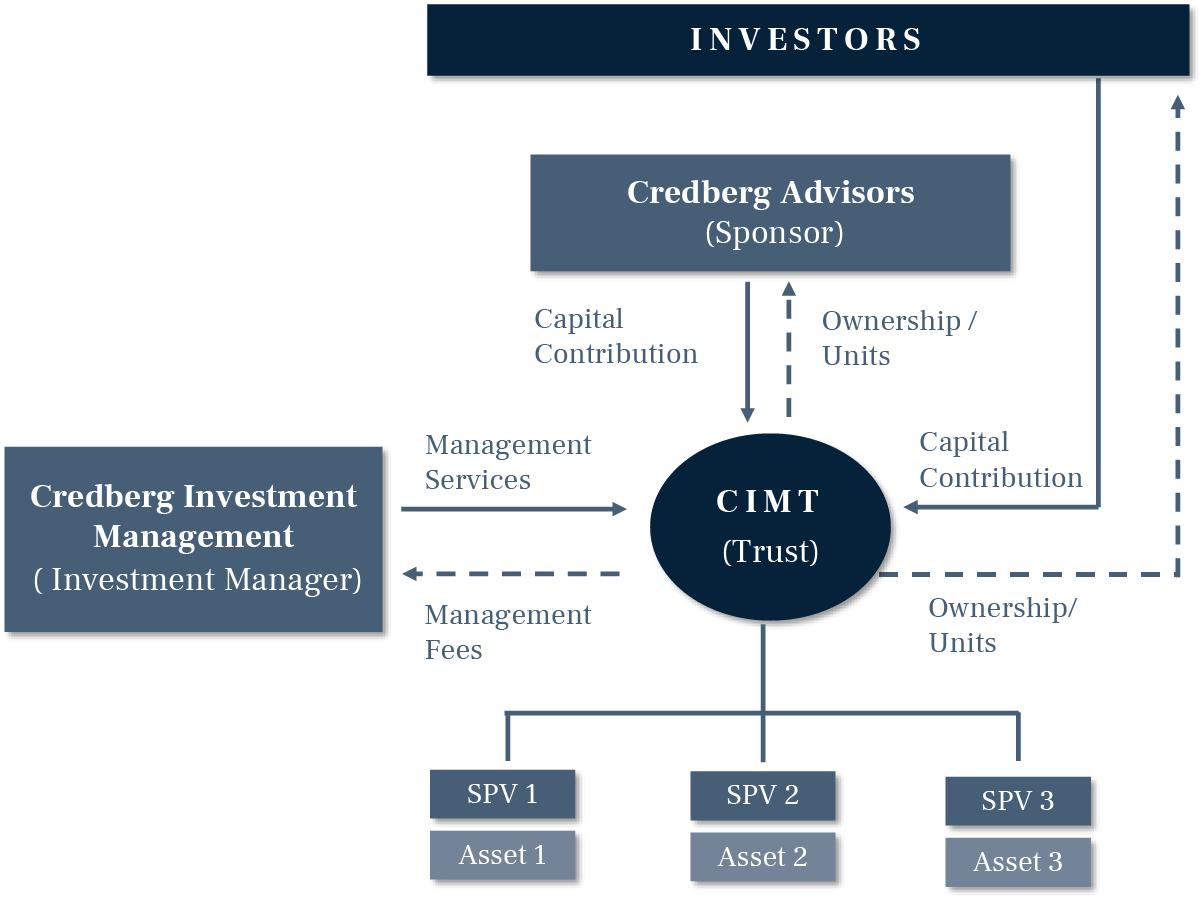

Fund Structure

AIF Scheme under the SEBI Regulations

A fund established or incorporated in India, which is a privately pooled vehicle for investment based on the stated investment policy/ objective

Mechanics and Key Aspects

- Investment Manager to manage the investments of the AIF set up as a trust

- Sponsor and other investors to receive units of AIF upon capital contribution/ investment

- Sponsor and other Investors to have different class of units

- AIF to make investments in identified real estate companies/assets

- Trustee appointed for the AIF and will be responsible for overseeing the process, ensuring compliance and regularly updating SEBI on the developments.

Sponsor Overview

Credberg is a solution focused boutique investment bank that draws on its expertise in real assets and its global network to provide corporate finance, asset brokerage and capital market services across all major real estate markets.

- Focused on sourcing deals with strong potential for cash-flows, but in need of capital

- Targeting Gross Portfolio IRR of upwards of 17% p.a.

- Have advised on office Real Estate focused deals in excess of US$ 2 Billion since 2007

- Advised on Investment and exits for assets across multiple economic cycles in India

- Stringent internal compliance and risk control practices

- Advisory Committee to have bird’s-eye view on Investments

- Top advisors to ensure compliance

- Credberg Investment Management set up with an independent team

- Driven by core values of “Value Creation with Mitigating Risk”

- The leadership has a long history of working together in multiple platforms and 50+ years of combined real estate experience.

- Driven by strong governance and analytical skill the team has previously worked with institutions such as Brookfield , Blackstone, F&C Reit, JLL & Standard Chartered Bank among others

INVESTMENT PHILOSOPHY

CIM’s approach to fund management focuses first and foremost on the clients and integrates the rich experience and full resources of the firm to maximize investment results.

INVESTMENT PROCESS

Our investment process combines research and market analysis, comprehensive due diligence, and proven market expertise to make attractive risk-adjusted investments.

ASSET MANAGEMENT

CIM believes every real estate asset to be a unique operating business that must be actively managed to achieve the portfolio’s investment objectives.

PRIVATE FUNDS

We offer investors access to a wide range of real estate investment opportunities, through both the direct and indirect routes.